In this article, we present a collection of Italian and international data regarding the current state of tourism trends and recovery. After a period of uncertainty spanning several years, the tourism sector appears to have finally embarked on a path towards recovery. Based on the initial provisional data provided by Istat for the two-month period of January-February 2023, the Italian tourism sector is displaying significant indications of improvement. Total visitor numbers have increased by 45.5 percent compared to the same period in the previous year, with foreign visitors experiencing a surge of 70.5 percent and domestic visitors rising by 28.8 percent.

When comparing Italy’s rates with other European Union countries, it is evident that Italy maintained its position as the fourth most visited destination in 2022, following Spain, France, and Germany. In terms of foreign visitors, Italy ranks second among EU countries, surpassed only by Spain.

If this positive trend persists in the upcoming months, 2023 could mark a complete recovery, even surpassing pre-pandemic levels. The certification provided by Istat serves as an encouraging indication for the Italian tourism sector and the nation’s overall economy.

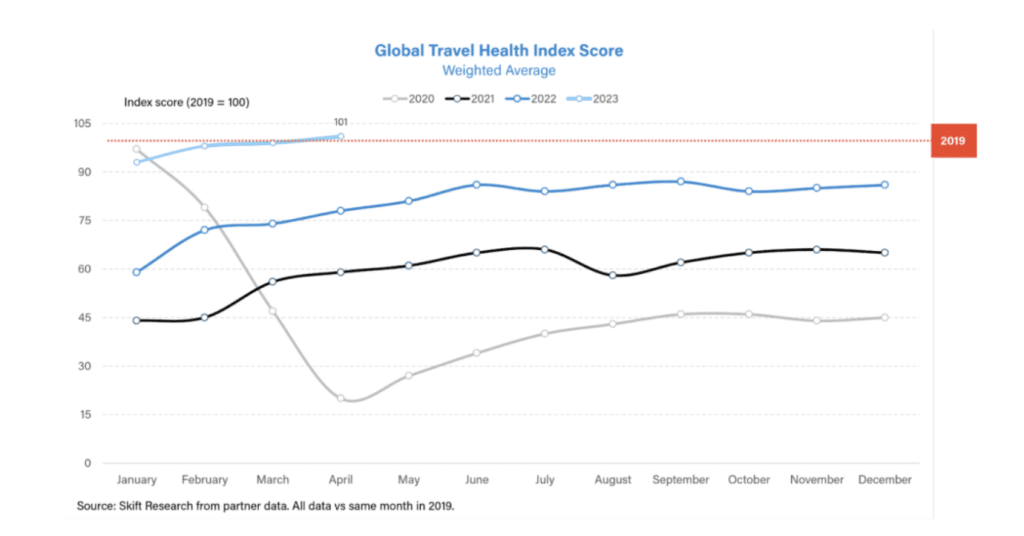

Skift Travel Health Index

The estimates from the Skift editorial office at the international level are highly intriguing.

For the first time since January 2020, Skift’s Travel Health Index has exceeded 100, indicating that global tourism is now surpassing its performance during the pre-pandemic period. Each region included in the index has experienced growth in the past month.

Skift: Travel is Back: Skift Travel Health Index Reaches Record High

Skift: Travel is Back: Skift Travel Health Index Reaches Record High

The Travel Health Index is a proprietary tool developed by Skift Research to monitor the progress of the travel industry. It uses 84 travel indicators sourced from 22 partners. Currently, the global index stands at 101, marking a 2 percentage point increase from the previous month.

At its lowest point, the index plummeted to 20 in April 2020, indicating that travel performance had declined to just 20 percent of the levels observed in April 2019.

At the international level very interesting are the estimates from the Skift editorial office.

A Regional Analysis

Latin America emerges as the leading region on the index, with Asia Pacific, the Middle East, and Africa also surpassing pre-pandemic levels in the past month. North America and Europe are on the cusp of achieving full recovery.

Revival Driven by Vacation Rentals

The vacation rental sector has experienced a notable resurgence, outpacing hotels in its recovery. In January 2022, the sector index surpassed 2019 levels by a significant 12 percentage points and has since continued to exceed pre-pandemic levels. As of January 2023, vacation rentals were performing 30-40% better than they did in 2019.

Air Travel Slowly Catching Up

The aviation sector has faced considerable challenges in its recovery, including soaring fuel costs, labor restrictions, and workforce shortages. However, it has exhibited a steady upward trajectory since late 2022. By April 2023, the sector had reached 85% of its pre-pandemic level.

Price Dynamics Over Quantity

While travel volumes have yet to fully rebound, the recovery has been primarily driven by higher prices. Globally, the average transaction value for hotel stays has increased by 13% compared to 2019 levels.

Comparing segments to the pre-pandemic era, the Group and Family segments have performed above average. Notably, the Families segment has experienced significant growth, currently up by 12% compared to April 2019. Additionally, the Single Traveler segment, which appears to be particularly sensitive to prices, has also seen a 12% increase compared to 2019 levels, as reported by TravelgateX data.

UNWTO World Tourism Barometer

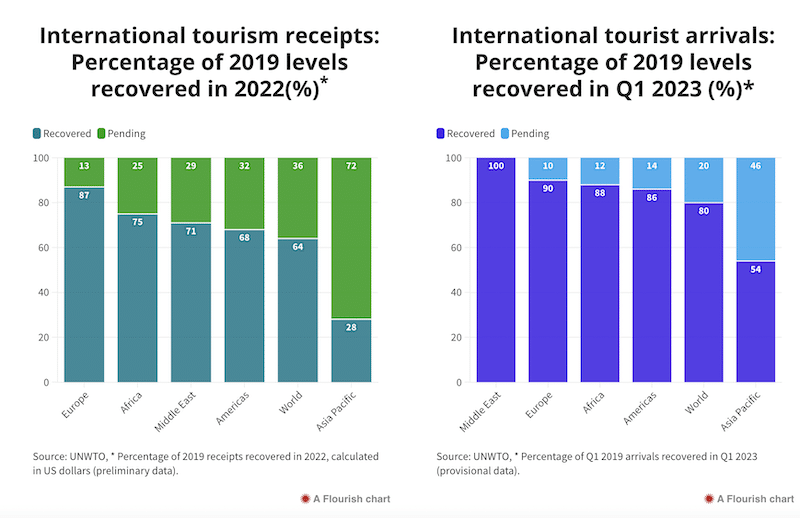

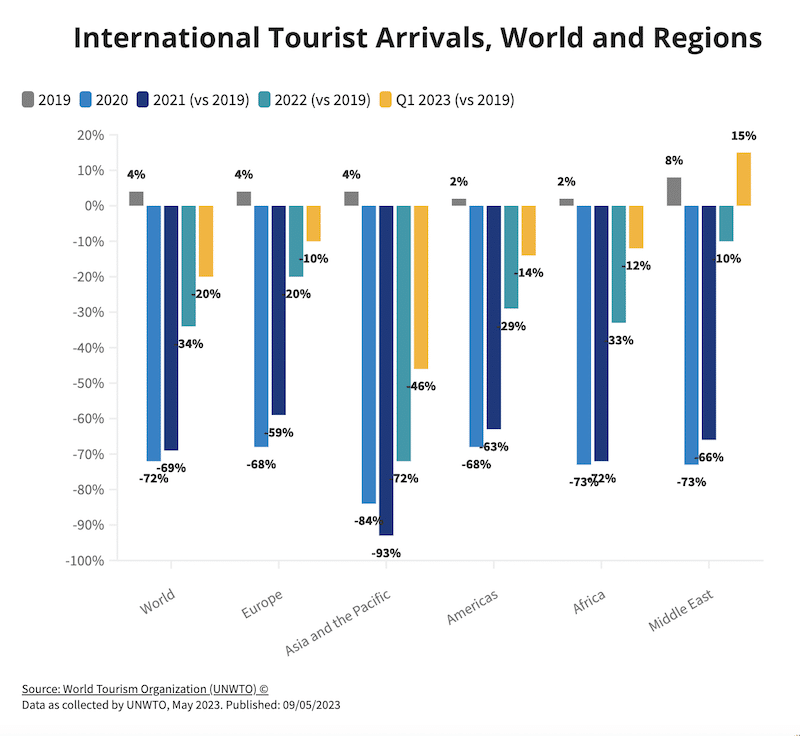

Positive figures from the UNWTO indicate progress in international tourism. During the first quarter of 2023, the number of international arrivals reached 80% of pre-pandemic levels, totaling over 235 million tourists.

According to the UNWTO’s second World Tourism Barometer of the year, the sector’s rapid recovery has continued into 2023. Here are some key figures:

- Overall, international arrivals reached 80% of pre-pandemic levels in the first quarter of 2023.

- Approximately 235 million tourists traveled internationally during the first three months, more than double the number for the same period in 2022.

- The tourism industry has exhibited resilience. Revised data for 2022 reveal that over 960 million tourists traveled internationally last year, equating to a recovery of two-thirds (66%) of the pre-pandemic figures.

Recovery by region in the first quarter of 2023 is as follows:

- The Middle East showcased the best performance, surpassing 2019 arrivals by 15% and becoming the first region to fully recover pre-pandemic numbers in a single quarter.

- Europe has reached 90% of pre-pandemic levels, driven by strong demand within the region.

- Africa has achieved 88% of 2019 levels, while the Americas have reached around 85%.

- Asia and the Pacific have accelerated their recovery, reaching 54% of pre-pandemic levels. This upward trend is expected to gain momentum as most destinations, particularly China, have reopened. In many places, arrivals are close to or even surpassing pre-pandemic levels.

UNWTO data also analyze the recovery by sub-region and destination: Southern Mediterranean Europe and North Africa reached pre-pandemic levels in the first quarter of 2023, while Western Europe, Northern Europe, Central America, and the Caribbean were close to achieving similar levels.

According to UNWTO Secretary General Zurab Pololikashvili, “The early months of the year have once again showcased the exceptional resilience of the tourism industry. In numerous destinations, we are nearing or have even surpassed the levels of visitor arrivals seen before the pandemic. However, it is crucial that we maintain a vigilant stance to address various challenges, including geopolitical security concerns, workforce shortages, and the potential repercussions of the energy cost crisis.”